Good response, and because of it I'm reading up on the Austrian business cycle right now, however I would be very grateful if you could return the favor and read the paper that I had put in my first post (note this isn't an article by a journalist, it's a proper academic paper, so it's pretty long and rigorous).Originally Posted by joe

Results 76 to 90 of 113

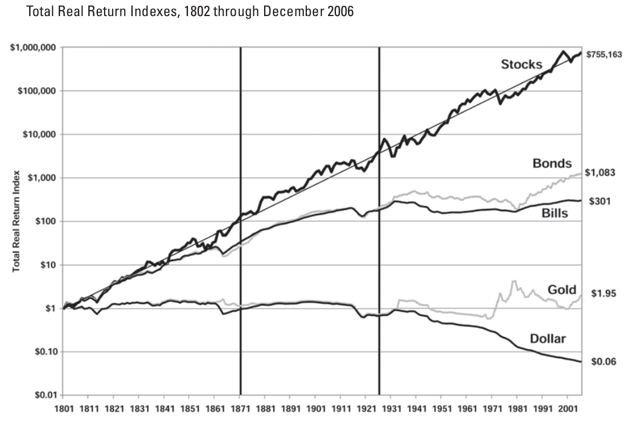

Thread: Gold is the best investment

-

06-10-2012, 05:01 AM #76

Re: Gold is the best investment

Re: Gold is the best investment

Last edited by brantonli; 06-10-2012 at 05:15 AM.

-

06-10-2012, 05:15 AM #77

Re: Gold is the best investment

Re: Gold is the best investment

Some comments from the blog post mentioned above that resonated with me

The BLS...Methods used are all posted online, and conform to international best-practice. ....Academic experts are free to challenge these methods, and from time to time do -

....

Yes, you're right. We have learned no economics since the 1970s when the "old" ways were being used. There have been no advances in measurement. The BLS should use the old method ....that the rest of the world has rejected these old methods only PROVES that these old methods are watertight and ironclad. Because after all, the old methods show that inflation is higher, and we KNOW that higher inflation is the case -- because we just know, that's all. (Don't confuse me with data.) All the PhD economist experts who insisted that the BLS change its methods are lunatic idiots, morons, imbeciles. We should definitely put faith in a shoestring operation which "corrects" the CPI in a way that implies that we were in the worst depression imaginable only a few decades ago.......If you have a valid criticism of the CPI, try to write a serious paper, present it before experts, and see if you have a case. So far, no one here has raised any credible issue; it is the wildly uninformed misleading the even more wildly uninformed. Please become informed, and actually read the MLR article before commenting......Measurement is an active area of research in economics. There are top PhD's writing papers in measurement all the time. Their papers are peer-reviewed and published in academic journals. Quoting Marginal Revolution, "Being pro-science means being pro economic science."

.......

the BLS does show what the CPI would be without the revisions. They publish it every month. It is called the CPI-RS and can be downloaded at BLS.

........

I asked, "Why do people give credibility to an operation like Shadowstats?", to which many of you offer answers along the lines of, "because we don't believe the BLS." But that's not a logical answer. Just because you doubt A is not a valid reason for accepting the truth of B.

And as for the question, "Why should we believe any BLS economists?", here's one answer: because you can check their math. Let me walk you through how Greenlees and McClelland's ice cream vs. yogurt example works. The arithmetic mean is

0.5(1.086 + 0.958) = 1.022

whereas the geometric mean is

(1.086)(0.958)^0.5 = 1.020

for a difference between the two measures of 1.022 - 1.020 = 0.002 or 0.2%. For those of you whose position is that "we believe Shadowstats because it's consistent with what we see around us," here is your homework assignment. Give me some plausible numbers, which you think are consistent with what you see around you, under which geometric averaging could reduce the reported inflation rate by something on the order of 3% per year, year after year.

And please show your work.

...................

The three major changes adopted by.....BLS indexes --- a geometric means for the use of substitution effects (a standard micro-economic concept dozens of decades old by now), an updated version of the 1981 measure of the cost of housing shelter for home-owners (a rental equivalent: guess what, 69% of Americans own their homes and aren't looking yearly to buy another), and a new view of quality changes --- are explained clearly and with simple examples that refute the conspiratorial charges as well as those that lead others to yell "cheaters!" and "con-men frauds!".

-

06-10-2012, 06:38 AM #78

Re: Gold is the best investment

Re: Gold is the best investment

Originally Posted by joe

Originally Posted by joe

I think if you presented this to a mainstream economist, this would be his objection:

and the link:Thus, it is readily conceded that (a) expansionary monetary policy reduces interest rates, and (b) lower interest rates stimulate investment in more round-about projects. Where then does the disagreement emerge? What I deny is that the artificially stimulated investments have any tendency to become malinvestments. Supposedly, since the central bank's inflation cannot continue indefinitely, it is eventually necessary to let interest rates rise back to the natural rate, which then reveals the underlying unprofitability of the artificially stimulated investments. The objection is simple: Given that interest rates are artificially and unsustainably low, why would any businessman make his profitability calculations based on the assumption that the low interest rates will prevail indefinitely? No, what would happen is that entrepreneurs would realize that interest rates are only temporarily low, and take this into account.

In short, the Austrians are assuming that entrepreneurs have strange irrational expectations. Rothbard states this fairly explicitly: "[E]ntrepreneurs are trained to estimate changes and avoid error. They can handle irregular fluctuations, and certainly they should be able to cope with the results of an inflow of gold, results which are roughly predictable. They could not forecast the results of a credit expansion, because the credit expansion tampered with all their moorings, distorted interest rates and calculations of capital."[48] Elsewhere, he informs us that: "[S]uccessful entrepreneurs on the market will be precisely those, over the years, who are best equipped to make correct forecasts and use good judgment in analyzing market conditions. Under these conditions, it is absurd to suppose that the entire mass of entrepreneurs will make such errors, unless objective facts of the market are distorted over a considerable period of time. Such distortion will hobble the objective 'signals' of the market and mislead the great bulk of entrepreneurs."[49]

http://econfaculty.gmu.edu/bcaplan/whyaust.htm

interestingly, this guy used to be an Austrian economist, although Bradford DeLong did call him the stupidest man alive.

-

06-10-2012, 07:46 AM #79

Re: Gold is the best investment

I'm not going to defend shadow stats. I didn't even find that graph on their website, and I've never heard of them before now, frankly.

Re: Gold is the best investment

I'm not going to defend shadow stats. I didn't even find that graph on their website, and I've never heard of them before now, frankly. Originally Posted by KevinNYC

Originally Posted by KevinNYC

You place too much importance on statistics, as I've said all along. The problem with statistics is that I, a human being, must interpret them. And a human being must create the formulas. And my human ideological opponents can interpret them in a different way. Statistics are helpful to me, but not the end all be all.

For interpreting economic/world events, I (try my best to) use the Austrian method of Praxeology. Praxeology is the study of human action. It uses logic to interpret economics, as opposed to mathematics. The very first axiom of Praxeology is that people act, and that people act with the intention of accomplishing certain goals (I may work overtime to buy new shoes, for example). By acting, I am assuming that attaining my goal will lead to a greater state than had I not acted. For instance, when Kev is rude to me though I haven't been rude to him, he believes his life will be better than had he not been rude to me.

To me, praxeology works great and helps to clear your mind. It lets you see through the endless statistics and focus strictly on action, and motivation.

Once you focus on human action and praxeology, it makes total sense that the Fed/government would want the CPI to understate inflation.

Not to mention, the Fed printing 600 billion dollars and giving it to their friends, in total secret, with no repercussions. A lower CPI hides all of the corruption and theft within the Fed.A lower CPI provides at least two major benefits to the government:

1. Many government payments, such as Social Security and the returns from TIPS, are linked to the level of the CPI; therefore, a lower CPI translates into lower payments - and lower government expenditures.

2. The CPI deflates some components used to calculate the real GDP - a lower inflation rate makes the economy look better than it really is.

Read more: http://www.investopedia.com/articles...#ixzz1xO5keViU

I highly suggest reading this article, especially the section on "CPI and consumer behavior."

http://www.investopedia.com/articles...#axzz1xO4mVjJE

-

06-10-2012, 09:41 AM #80

Re: Gold is the best investment

Hey, I'll check out that article you posted sometime today or tomorrow, and post my thoughts on it in here, or send you a PM. I appreciate you checking out the Austrian Business Cycle theory, it's a lot to get into. I have a response to this quote too, but I can't go into it now. This kind of critique of the ABCT is pretty common, and the Austrians have given some good responses. Till then..

Re: Gold is the best investment

Hey, I'll check out that article you posted sometime today or tomorrow, and post my thoughts on it in here, or send you a PM. I appreciate you checking out the Austrian Business Cycle theory, it's a lot to get into. I have a response to this quote too, but I can't go into it now. This kind of critique of the ABCT is pretty common, and the Austrians have given some good responses. Till then.. Originally Posted by brantonli

Originally Posted by brantonli

-

06-10-2012, 09:50 AM #81

Re: Gold is the best investment

Re: Gold is the best investment

So stats is prone to human bias but praexology is somehow more objective. I'm sorry but that makes no sense.

-

06-10-2012, 11:04 PM #82

Re: Gold is the best investment

I once read a gentleman never offends unintentionally, so if I've been rude, I apologize.

Re: Gold is the best investment

I once read a gentleman never offends unintentionally, so if I've been rude, I apologize. Originally Posted by joe

Originally Posted by joe

I thought of it more as collegial jesting, but tone often is misunderstood with just written text.

Then I'm not sure what you thought that graph was showing since if we don't know what SGS is, what's the point of the chart? Originally Posted by joe

Originally Posted by joe

You may know this already but one than one writer posts under the name "Tyler Durden" at Zero Hedge. It becomes rather confusing. If you read that blog for long enough, you'll find Tyler being outraged over both sides of an issue. Originally Posted by joe

Originally Posted by joe

There's a lot of questions that can be raised about the Fed's response to the financial crisis, and even about the $600 billion you mentioned. But you have two consider.

A. The 600 billion you mentioned were loans lend for short periods and backed by high-quality collateral and then repaid with interest. So "giving it the their friends" and "corruption and theft" are highly misleading.

B . The reason the Fed was lending like this in the first place was the commercial credit markets were not functioning. We were in the midst of a failure of the market.

C. By taking these and other actions to stabilize the financial markets a depression was averted.

-

06-11-2012, 10:58 AM #83College star

- Join Date

- Mar 2007

- Posts

- 4,236

Re: Gold is the best investment

Re: Gold is the best investment

Originally Posted by Norcaliblunt

Originally Posted by Norcaliblunt

Originally Posted by Godzuki

Originally Posted by Godzuki

-

04-15-2013, 05:42 PM #84NBA Legend and Hall of Famer

- Join Date

- May 2010

- Posts

- 23,163

Re: Gold is the best investment

Re: Gold is the best investment

http://abcnews.go.com/blogs/business...t-in-30-years/

Gold dropped $144 an ounce, the biggest drop in 30 years.

-

04-15-2013, 05:45 PM #85

Re: Gold is the best investment

Re: Gold is the best investment

you buy when its cheap, not when its trending. or else u end up broke like OP.

you buy when its cheap, not when its trending. or else u end up broke like OP.

-

04-15-2013, 09:26 PM #86Banned

- Join Date

- Mar 2012

- Posts

- 5,924

Re: Gold is the best investment

Long term trends homie. If OP holds onto it he can still make a long-term gain.

Re: Gold is the best investment

Long term trends homie. If OP holds onto it he can still make a long-term gain. Originally Posted by nathanjizzle

Originally Posted by nathanjizzle

-

04-15-2013, 10:07 PM #87

Re: Gold is the best investment

In the long term, we're all dead.

Re: Gold is the best investment

In the long term, we're all dead. Originally Posted by HarryCallahan

Originally Posted by HarryCallahan

But the OP recommended one of the worst times ever to buy gold, very near the top of a historical bubble in gold. It's one reason you don't take yourAlso had you ignored the OP's advice just bought a fund that match the Dow Jones, you would have a nice gain over the past year.investment advice from Ron Paul

A few weeks ago, we figured out what was happening to the Ron Paul portfolio — the former Texas congressman's 64% investment in gold and other rocks — and it wasn't pretty.

His portfolio is comprised of major miners and a handful of juniors, and displays a marked lack of diversification.

Investment manager William Bernstein told the Wall Street Journal that “This portfolio is a half-step away from a cellar-full of canned goods and nine-millimeter rounds.”

All told, the average loss was -40.3% over the past six months

Given that The Wall Street Journal reported that Paul's portfolio was worth between $2.44 million and $5.46 million — and that 64 percent of his assets were in these precious metal stocks — a very loose estimate is that Ron Paul has lost between $624,640 and $1,397,760 over the past six months, based on the average loss of his mining holdings. This assumes a 40.3% loss on 64% of his holdings.Last edited by KevinNYC; 04-15-2013 at 10:17 PM.

-

04-15-2013, 10:31 PM #88

Re: Gold is the best investment

This means people are more optimistic about the economy...possibly worldwide....1983 was a year when a strong recovery began after a steep recession.

Re: Gold is the best investment

This means people are more optimistic about the economy...possibly worldwide....1983 was a year when a strong recovery began after a steep recession. Originally Posted by Sarcastic

Originally Posted by Sarcastic

EDIT Or it could mean that growth in China is weak and they will be buying less gold.

http://www.reuters.com/article/2013/...93E0LK20130415Last edited by KevinNYC; 04-15-2013 at 10:33 PM.

-

04-15-2013, 10:39 PM #89Certified ISHiot.

- Join Date

- Jul 2006

- Posts

- 19,080

Re: Gold is the best investment

Re: Gold is the best investment

-

04-15-2013, 11:29 PM #90Banned

- Join Date

- Mar 2012

- Posts

- 5,924

Re: Gold is the best investment

Too short term focused son, Ron Pauls portfolio has performed well over the last 20 years. One year doesn't make or break investment strategies.

Re: Gold is the best investment

Too short term focused son, Ron Pauls portfolio has performed well over the last 20 years. One year doesn't make or break investment strategies. Originally Posted by KevinNYC

Originally Posted by KevinNYC

Reply With Quote

Reply With Quote