Lol.

Time to adopt the minimalist lifestyle.

Bout to throw away the games and the TV and take on a 2nd job too.

Results 31 to 45 of 57

-

10-08-2013, 01:26 PM #315-time NBA All-Star

- Join Date

- Jan 2008

- Location

- Connecticut

- Posts

- 11,671

Re: so its looking like the US will default on it's debt...

Re: so its looking like the US will default on it's debt...

-

10-08-2013, 02:17 PM #32

Re: so its looking like the US will default on it's debt...

Re: so its looking like the US will default on it's debt...

Obama should just wipe out the debt ceiling as a political maneuver by minting the trillion dollar platinum coin. An Ender Wiggins mentality is needed here. He needs to win this debt ceiling battle and all the other ones after it.

-

10-08-2013, 02:54 PM #33

Re: so its looking like the US will default on it's debt...

Re: so its looking like the US will default on it's debt...

Originally Posted by KevinNYC

Originally Posted by KevinNYC

Your faith in the Federal Reserve, or your belief that it serves the American people is misguided. Of course the Federal Reserve doesn't want the U.S. economy to collapse (yet), because that's where it makes its money. However, at the end of the day, the Federal Reserve is a privately owned bank/business, that is concerned only with the bottom line. Once we reach a point where the Federal Reserve no longer sees the U.S. as a reliable debtor, they will do what makes sense from a business perspective, regardless of what happens to the American people.

The Fed has already shown its willingness to place profit over the American people when it almost single handedly caused the Great Depression. For those of you who aren't aware of what caused the Great Depression, it went something like this: The Fed progressively raised interest rates during a recession (which it caused) which led to a Stock Market crash. The ensuing panic caused a run on the dollar (inflation). The Fed then raised interest rates (restricting cash flow) causing massive bank failures across the Country. The Fed then refused to increase the money supply, leading to even more catastrophic bank failures, and an almost complete collapse of the U.S. banking system.

The Federal Reserve had the power to completely avoid the Great Depression, and they chose to do nothing. The notion that they wouldn't allow the U.S. economy to collapse again is nonsense. In fact, the bubble the Fed is building now is substantially larger than the one they built before the Great Depression. Although our understanding of economics is obviously better than it was in the 1920's, that doesn't change the fact that the Fed is holding all the cards, and a couple shifts in policy regarding interest rates and/or money supply could plunge the U.S. into another depression. The idea that the Fed is just going to continue to expand the money supply and keep interest rates low forever is beyond optimistic, and borderline delusional.

-

10-08-2013, 03:04 PM #34

Re: so its looking like the US will default on it's debt...

Re: so its looking like the US will default on it's debt...

The federal reserve is not going to send the world spiraling into chaos (everyone's economies are intertwined, you don't get to see the US spiral solo, everyone would go). Do you really believe this is what is going to happen in the next two weeks? The Federal Reserve decides to be completely inflexible and destroy the economy?

Remember if you are a creditor, once you slam the debtor, you don't get your money back necessarily.

Not a chance in hell this isn't worked out somehow in the next few weeks. I think some of you just like the more morbid scenarios.

-

10-08-2013, 03:14 PM #35

Re: so its looking like the US will default on it's debt...

Re: so its looking like the US will default on it's debt...

I don't like Great Depression comparisons...that was 100 years ago

today's US economy isn't structured the same at all...it is entangled with every other countries' economies...it's global

-

10-08-2013, 03:16 PM #36

Re: so its looking like the US will default on it's debt...

Re: so its looking like the US will default on it's debt...

Where did I say anything about this happening in the next two weeks?

Eventually it will happen. There is no other conclusion to this story. When it happens, and how bad the ensuing fall out will be, is still to be determined.

-

10-08-2013, 03:19 PM #37

Re: so its looking like the US will default on it's debt...

Re: so its looking like the US will default on it's debt...

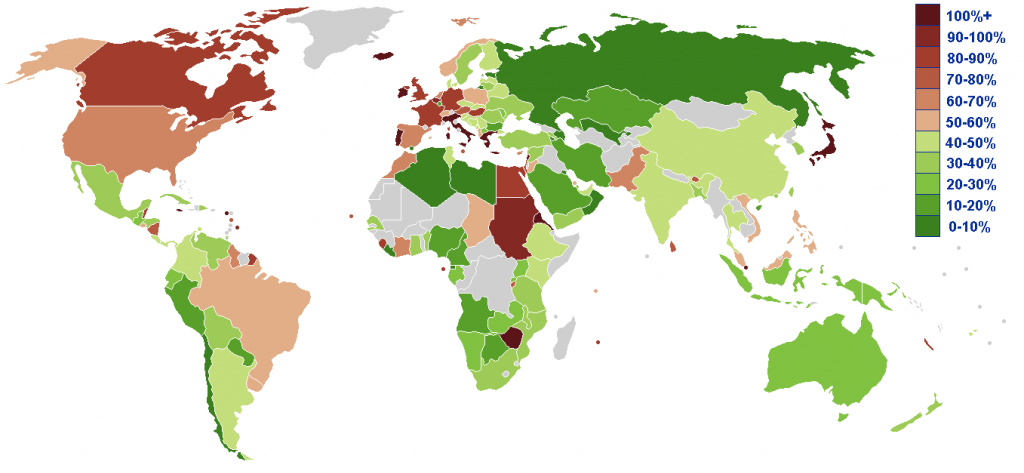

just came across this (wikipedia)

it's the public debt in percent of the gdb

you hear so much about the USA owing crazy money, I would not have thought that Canada does worse

Eastern Europe is certainly not a role model

still kind of crazy. I calculated that every US citizen (all ages) owes about 50k

but as for a state, I think is good to be in dept in the long run. but probably not as much. I don't now.

-

10-08-2013, 03:24 PM #38Very good NBA starter

- Join Date

- Jun 2006

- Posts

- 8,356

Re: so its looking like the US will default on it's debt...

Re: so its looking like the US will default on it's debt...

Originally Posted by DonD13

Originally Posted by DonD13

this chart is soooo dated. wikipedia doesn't keep up too well.

Debt is at nearly $17 trillion

GDP is slightly below $16 trillion

so current debt/gdp in US is well over 100%

color on the map would be a lot darker

-

10-08-2013, 03:26 PM #39

Re: so its looking like the US will default on it's debt...

Re: so its looking like the US will default on it's debt...

my bad it's 2007

my bad it's 2007

I didn't thought that article would be so out dated, I'm sorry, I tried, I'm out

-

10-08-2013, 04:04 PM #40NBA Superstar

- Join Date

- Dec 2010

- Posts

- 13,283

Re: so its looking like the US will default on it's debt...

the Fed deserves a lot of credit for our economic recovery from the low point of the recession to today. of course interest rates will rise but not when we're recovering and they want people to spend. people will still spend when the economy is better off and interest rates are higher, but there will already be more money in peoples pocket at that point. i don't really get why people think they're so evil.

Re: so its looking like the US will default on it's debt...

the Fed deserves a lot of credit for our economic recovery from the low point of the recession to today. of course interest rates will rise but not when we're recovering and they want people to spend. people will still spend when the economy is better off and interest rates are higher, but there will already be more money in peoples pocket at that point. i don't really get why people think they're so evil. Originally Posted by bdreason

Originally Posted by bdreason

-

10-08-2013, 04:45 PM #41

Re: so its looking like the US will default on it's debt...

Eventually the sun will burn out and all life will cease too.

Re: so its looking like the US will default on it's debt...

Eventually the sun will burn out and all life will cease too. Originally Posted by bdreason

Originally Posted by bdreason

-

10-08-2013, 04:47 PM #42NBA rookie of the year

- Join Date

- Jun 2011

- Posts

- 6,157

Re: so its looking like the US will default on it's debt...

Re: so its looking like the US will default on it's debt...

we are not going to default wall street doesn't want us to default.

-

10-08-2013, 04:48 PM #43NBA rookie of the year

- Join Date

- Jun 2011

- Posts

- 6,157

Re: so its looking like the US will default on it's debt...

Japan's debt is more than double its GDP.

Re: so its looking like the US will default on it's debt...

Japan's debt is more than double its GDP. Originally Posted by DCL

Originally Posted by DCL

-

10-08-2013, 05:50 PM #44

Re: so its looking like the US will default on it's debt...

The chart is for debt held by the public. Which is currently 73% of GDP as of September. So that chart looks accurate.

Re: so its looking like the US will default on it's debt...

The chart is for debt held by the public. Which is currently 73% of GDP as of September. So that chart looks accurate. Originally Posted by DCL

Originally Posted by DCL

There's a lot of the debt that is held by government.

-

10-08-2013, 10:02 PM #45Very good NBA starter

- Join Date

- Jun 2006

- Posts

- 8,356

Re: so its looking like the US will default on it's debt...

you're wrong.

Re: so its looking like the US will default on it's debt...

you're wrong. Originally Posted by KevinNYC

Originally Posted by KevinNYC

that chart is for government debt.

you can tell it's government debt by looking around the other countries. it's quite obvious.

besides, if you still can't figure that it's government debt. it SAYS it's government debt.

http://en.wikipedia.org/wiki/Debt-to-GDP_ratio

Reply With Quote

Reply With Quote