it isn't just 401ks obviously but there are plenty of people retiring right now as I type this...or this year altogether, and I promise you they are happy about the Dow right nowOriginally Posted by ALBballer

part of the problem in here is that that average poster is young, never touched the market

if the age range in here was 40-60 year olds, this thread would have a completely different tune

Results 31 to 45 of 123

Thread: Dow hits new record high

-

03-05-2013, 06:53 PM #31

Re: Dow hits new record high

Re: Dow hits new record high

-

03-05-2013, 07:12 PM #32

Re: Dow hits new record high

Re: Dow hits new record high

I don't think this is "real". Nothing has really changed since the meltdown 5 years ago besides the fed printing money.

There hasn't been a "true" recovery.

If you notice, the improvement in the stock market has followed the increase in money printing, to a tee.

This crazy amount of money hasn't fully reached the markets/economy yet, but it will, this is a fact, unless they destroy the money, which they won't do. It is also a fact that when this happens, inflation/interest rates will go up, and there will be a huge market correction. These are facts, you can calculate this mathematically.

When inflation/interest goes up, companies will be spending more money on borrowing costs than business expansion costs. That means lower profit margins, lower dividends, and less hiring. Plus, more layoffs. Which means that consumer spending will go down...and ya'll know that the U.S. economy mostly depends on consumer spending.

Don't let this current "good news" fool you. There is still a huge bubble.

Why do you think Warrent Buffet, the master, the biggest cheerleader for U.S. company stocks, is dumping over 20% of his stocks that depend on consumer spending? Why do you think that he dumped his whole stake in Intel? Why do you think he sold 19 million shares of Johnson&Johnson?

Why do you think John Paulson just dumped 14 million shares of JP Morgan Chase?

Why do you think George Soros sold all of his bank stocks?

They are thinking ahead.

-

03-05-2013, 07:19 PM #33

Re: Dow hits new record high

Re: Dow hits new record high

no inflation is very low right now despite the "money printing"

in fact in 2008 we were almost deflating

just because we print money, that doesn't mean it stays in the US

that being said I think that perhaps some of this is inflation...def not all of it though...the stock market isn't just an indicator of inflation

here are inflation rates:

http://www.usinflationcalculator.com...flation-rates/

we are at 1.6% right now, that is very low

-

03-05-2013, 07:26 PM #34

Re: Dow hits new record high

Trust me it won't stay that low. It's b/c the money hasn't fully hit the markets and economy yet.

Re: Dow hits new record high

Trust me it won't stay that low. It's b/c the money hasn't fully hit the markets and economy yet. Originally Posted by -p.tiddy-

Originally Posted by -p.tiddy-

-

03-05-2013, 07:40 PM #35

Re: Dow hits new record high

since the "bail out" it has...for sure

Re: Dow hits new record high

since the "bail out" it has...for sure Originally Posted by lefthook00

Originally Posted by lefthook00

that is all the "money printing" you speak of right?

hell, some companies, like AIG, have already paid back their bail out money...

what do you think has to happen before the money "fully hits the economy"?...it hits right away...you think the money is just lounging around not doing anything?

-

03-05-2013, 08:00 PM #36College star

- Join Date

- Mar 2007

- Posts

- 4,247

Re: Dow hits new record high

Re: Dow hits new record high

The money fetish continues. We need production, production, and production.

-

03-05-2013, 08:05 PM #37

Re: Dow hits new record high

I'm not talking about right now, I'm talking about what's going to happen in the near future. Printing money isn't inflationary under current conditions, but these conditions won't last forever. The fed is eventually going to have to sell off the debt it bought, which means it will eventually turn into debt held by the public. That's what I meant by that.

Re: Dow hits new record high

I'm not talking about right now, I'm talking about what's going to happen in the near future. Printing money isn't inflationary under current conditions, but these conditions won't last forever. The fed is eventually going to have to sell off the debt it bought, which means it will eventually turn into debt held by the public. That's what I meant by that. Originally Posted by -p.tiddy-

Originally Posted by -p.tiddy-

-

03-05-2013, 08:16 PM #38

Re: Dow hits new record high

Yes the Fed is buying securites and Treasury Bonds, but not stocks. They are not directly juicing the stock market. Neither of these directly affect corporate profits which is what is driving stock prices.

Re: Dow hits new record high

Yes the Fed is buying securites and Treasury Bonds, but not stocks. They are not directly juicing the stock market. Neither of these directly affect corporate profits which is what is driving stock prices. Originally Posted by boozehound

Originally Posted by boozehound

The Fed is making credit more easily available throughout the economy not just the stock market. It's not like people are using this free credit to buy stocks and that is what is driving up stock prices. That's not how it works. (Econ or Finance folks can correct if I'm wrong on this.) What the Fed is doing affects millions of people who are not involved in the stock market.

Car Sales are up.

Housing prices are climbing again. (P.tiddy was that you talked about the time to buy about 8 months ago?)

I'm going to refinance my debt soon. Buying mortgage backed securities is a way of freeing up credit, so it directly affects only a small number of companies and is not enough by itself to buoy the stock market.

-

03-05-2013, 08:28 PM #39

Re: Dow hits new record high

Re: Dow hits new record high

yeah that was me, and yes the housing market is recovering now

that is another good indicator

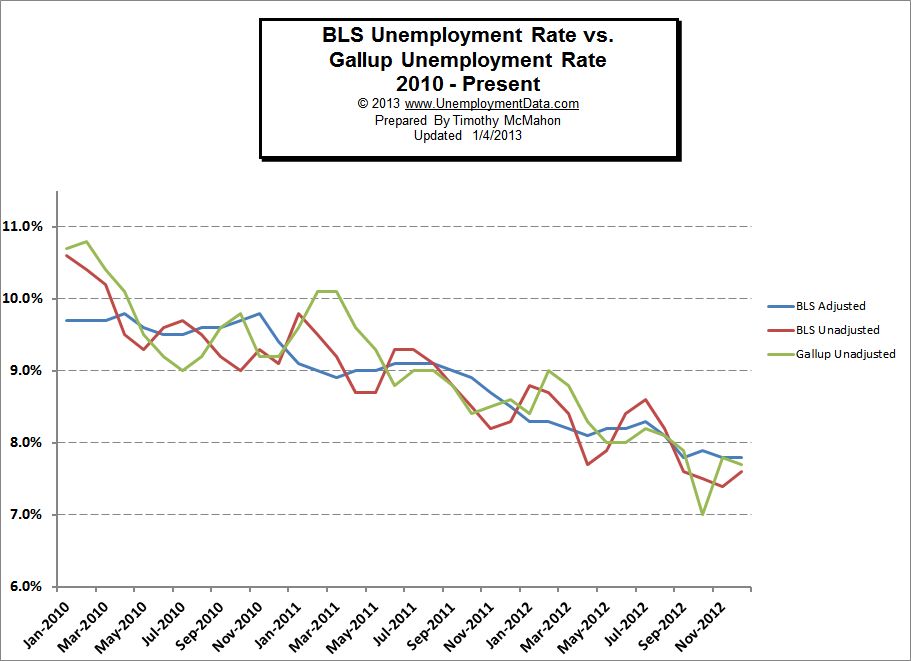

^^^ that is yet another good indicator...unemployment is streadaly going down

I didn't make this thread to say "we are back! everything is awesome!"...but how can anyone ignore the fact that we are making progress and are in fact on the road to recovery?

I know Doom and Gloom is popular, but at some point people have to come out and say "okay, well maybe I was wrong, maybe this whole bail out idea actually did work for us"

-

03-05-2013, 08:36 PM #40

Re: Dow hits new record high

Yeah he only did that because he was running for President and didn't want his tax rate to look really bad. And since he lost the election, he is totally within his rights to file an amended return and claim that income. I would bet a month salary he only didn't claim of donations for the years that he released his returns.

Re: Dow hits new record high

Yeah he only did that because he was running for President and didn't want his tax rate to look really bad. And since he lost the election, he is totally within his rights to file an amended return and claim that income. I would bet a month salary he only didn't claim of donations for the years that he released his returns. Originally Posted by ALBballer

Originally Posted by ALBballer

The loophole I was talking about is called Carried Interest. To this day Romeny is gettting partnership money from Bain Capital and is structured in a way, that there is virtually no risk to it, but it qualifies as a capital gain. This is literally the way that the rich have gotten richer in recent years.

[QUOTE]A Costly and Unjust Perk for Financiers

OF the many injustices that permeate America

-

03-05-2013, 08:39 PM #41College star

- Join Date

- Mar 2007

- Posts

- 4,247

Re: Dow hits new record high

Re: Dow hits new record high

Originally Posted by -p.tiddy-

Originally Posted by -p.tiddy-

The problem is homie, nothing has been done to stop another crash from happening again. No significant policy change or anything. History will repeat itself, as it did repeat itself in the fashion of the Great Depression during 2007 and 2008. So that leaves a lot to be desired. As for the bailouts, the fed could've issued 0% interest loans to those involved in actual tangible production rebuilding America, instead of giving it to the zombie banks, and a much faster and productive recovery would of happened.

-

03-05-2013, 08:48 PM #42

Re: Dow hits new record high

This is simply not true. We are no longer in crisis and the fundamentals of the economy have stabilized.

Re: Dow hits new record high

This is simply not true. We are no longer in crisis and the fundamentals of the economy have stabilized. Originally Posted by lefthook00

Originally Posted by lefthook00

And it's wrong to say the money hasn't hit the economy yet. It's just not true. In fact what the past few years have proven is that under the current circumstances with very low demand (due to unemployment) and interest rates near zero you can increase the money supply without driving up inflation.

It just a very special set of circumstances at economists call the Liquidity Trap or the Zero Lower Bound problem. This is why the all the folks screaming that the US is going to turn into Zimbabwe have been wrong year after year.

Actually destroying the money is exact what Bernanke intends to do. The previous Fed Chairman Paul Volcker calls this "taking away the punch bowl" once the party gets going good. If you are using low interest rates to spur the economy, you want to raise the interest rates when the economy gets going good, so that it doesn't overheat. "Destroying the money" is a standard tool of Federal Bankers and creating a tight money supply is how Volcker broke the back of inflation from 1979-83. Originally Posted by lefthook00

Originally Posted by lefthook00

You seem to be describing adjustable rate interest loans, your scenario only occurs if they borrowed their money at an adjustable rate which they didn't. That's for unsophisticated home buyers. Companies will be paying what the rate they borrowed at now (which is why they should borrow now and invest in their company or in bridges and roads or a 21st century infrastructure if you're a government). What happens when the interest rates go up is they will borrow less...see the punch bowl analogy above)When inflation/interest goes up, companies will be spending more money on borrowing costs than business expansion costs.They might be thinking ahead, but they are also professional traders who understand "taking a profit and exiting the market." Yes, the market just hit near six year peak, so they will take their profit and make decisions on where to invest that money. It might be they think there will be a selloff and they could buy back those very same stock cheaper in a month or two. They are very used to closing out a trade and restarting at zero gained or lost.Why do you think Warrent Buffet, ....Why do you think John Paulson....Why do you think George Soros.....

They are thinking ahead.Last edited by KevinNYC; 03-05-2013 at 09:03 PM.

-

03-05-2013, 09:04 PM #43

Re: Dow hits new record high

the market will go up and down for eternity...other recessions and booms will happen, that is a given...there is no law that can fix everything for good

Re: Dow hits new record high

the market will go up and down for eternity...other recessions and booms will happen, that is a given...there is no law that can fix everything for good Originally Posted by Norcaliblunt

Originally Posted by Norcaliblunt

inflation will happen for eternity, at some point a cheeseburger will cost $100 instead of $1...that doesn't matter though, it's all relative

out debt will rise forever, at some point we will look back at our current debt and think it is low (what $16 trillion?)...but people will bitch about it for eternity and act as though one day someone is going to come along and force us to pay it off...I can remember my own parents bitching about our ridiculous debt back in the 80s.

and there will ALWAYS be people that declare the country is Doomed...always have been, always will be.

in the end, as long as there is no nuclear war, we will be fine...

what we saw was no where near the "Great Depression" btw

-

03-05-2013, 09:11 PM #44College star

- Join Date

- Mar 2007

- Posts

- 4,247

Re: Dow hits new record high

Now who's pessimistic. Lol.

Re: Dow hits new record high

Now who's pessimistic. Lol. Originally Posted by -p.tiddy-

Originally Posted by -p.tiddy-

-

03-05-2013, 09:13 PM #45College star

- Join Date

- Mar 2007

- Posts

- 4,247

Re: Dow hits new record high

Re: Dow hits new record high

You also didn't address the point I made about how a faster and more productive recovery could take place.

Reply With Quote

Reply With Quote