Results 406 to 420 of 435

Thread: Stock Market is f*cked

-

05-12-2025, 08:39 AM #406

-

05-12-2025, 08:46 AM #407

Re: Stock Market is f*cked

Re: Stock Market is f*cked

https://www.cnn.com/2025/05/12/inves...ade-deal-china

Dow set to soar 1,000 points after Trump team dramatically lowers tariffs with China

-

05-12-2025, 09:17 AM #408

Re: Stock Market is f*cked

Re: Stock Market is f*cked

Stock market futures soar after U.S. and China suspend tariffs for 90 days

The U.S. reduced its levies on Chinese imports to 30% from as high as 145%, while China cut its tariffs on American goods to 10% from 125%. The deal followed a meeting in Switzerland this weekend involving U.S. Treasury Secretary Scott Bessent, U.S. Trade Administrator Jamieson Greer and Chinese negotiators.

S&P 500 futures were up 179 points, or 3.2%, as of 7:15 a.m. EST, while Dow Jones Industrial Average futures soared more than 1,000 points, or 2.5%, and Nasdaq Composite futures jumped 822 points, or 4%.

"While the lower tariffs are technically only in place for 90 days, and 30% is still quite large on an absolute basis, the news is clearly an upside positive surprise," equities analyst Adam Crisafulli, head of Vital Knowledge, told investors in a research note.

Bessent said the temporary reductions would effectively reduce the level of U.S. tariffs still in place on Chinese goods to about 30%, while China was reducing its levies on American imports to 10%.

Global stock markets also rose on news of the U.S. and China de-escalating the trade conflict, if only temporarily. Hong Kong surged 3%, Germany's DAX gained 1%, France's CAC 40 in Paris added 0.8% and Britain's FTSE 100 ticked up 0.1% higher.

Despite the signs of progress in easing tensions between the world's two largest economies, some market analysts warned that the road ahead remains uncertain.

https://www.cbsnews.com/news/stock-m...ow-s-p-nasdaq/

-

05-12-2025, 11:27 AM #409

Re: Stock Market is f*cked

Re: Stock Market is f*cked

"Stocks soaring this morning on China trade deal news. Hope you bought the dip! S&P up nearly 1000 points in a month. At minimum I hope you didnít listen to the left wing morons trying to terrify you into selling. I tried to tell you.

https://x.com/ClayTravis/status/1921...378826270?s=19

-

05-12-2025, 05:36 PM #410Decent playground baller

- Join Date

- Feb 2021

- Posts

- 395

-

05-16-2025, 08:42 PM #411

Re: Stock Market is f*cked

Re: Stock Market is f*cked

The market will be down on Monday.

https://www.bbc.com/news/articles/c4ge0xk4ld1o

Moody's downgrades US credit rating citing rising debt

The US has lost its last triple-A credit score from a major ratings firm after being downgraded by Moody's, which cited growing federal debt over the past decade.

In lowering the US rating to 'Aa1', Moody's noted that successive US administrations had failed to reverse ballooning deficits and interest costs.

A triple-A rating signifies a country's highest possible credit reliability, and indicates it is considered to be in very good financial health with a strong capacity to repay its debts.

Moody's warned in 2023 the US triple-A rating was at risk. Fitch Ratings downgraded the US in 2023 and S&P Global Ratings did so in 2011.

Growing Federal Debt is a problem? Who would've ever thought?

-

05-16-2025, 08:42 PM #412

Re: Stock Market is f*cked

Re: Stock Market is f*cked

I thought the National Debt was just money that we owe to ourselves. smh.

-

05-16-2025, 11:41 PM #413Local High School Star

- Join Date

- Jun 2021

- Posts

- 1,690

Re: Stock Market is f*cked

Re: Stock Market is f*cked

Did you read that? The US had a "perfect" credit rating according to them. Highest possible rating, in great financial health. Now it's AA1, or next to perfect.

And yes, most of our debt is domestic. We didn't borrow $4 trillion from China to pay for covid. The FED just printed it. But when you do that you lose standing in the world. However during covid almost everyone else did worse than the US. That's why we were still AAA until now.

-

05-17-2025, 09:29 AM #414

Re: Stock Market is f*cked

Re: Stock Market is f*cked

When you print $4 trillion out of thin air you create inflation.

When your debt to GDP ration has been over 100% the past decade... you are living beyond your means.

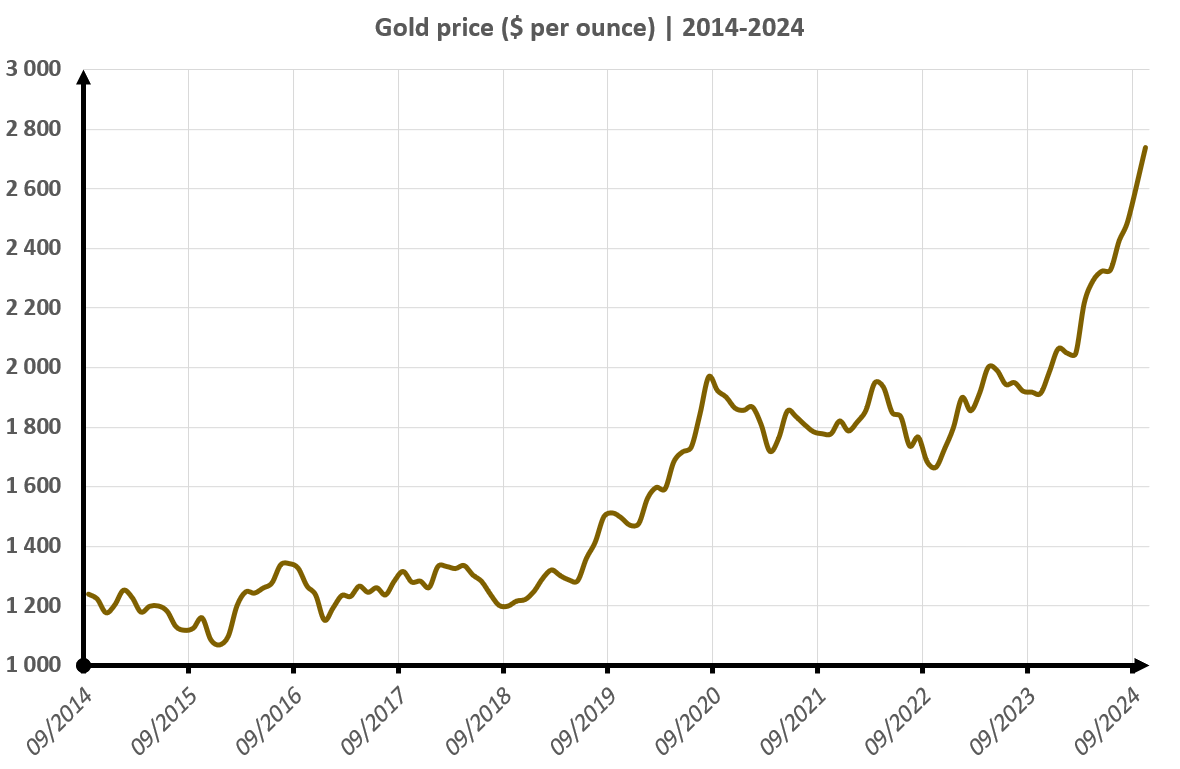

It's an unsustainable system that constantly has to raise the debt ceiling... and it's also the reason why the price of Gold is skyrocketing (as Ron Paul always suggested it would).

Either way the market should take a hit on Monday.

-

05-21-2025, 01:25 PM #415

Re: Stock Market is f*cked

Re: Stock Market is f*cked

You should have known it was a bubble when people were investing in meme coins and they were saying the wnba was profitable.

-

05-25-2025, 11:16 AM #416

-

05-25-2025, 12:22 PM #417Local High School Star

- Join Date

- Jun 2021

- Posts

- 1,690

Re: Stock Market is f*cked

Re: Stock Market is f*cked

yes that was my point.

You said:

"I thought the National Debt was just money that we owe to ourselves. smh."

It IS. The Fed supposedly "lends" us $4 trillion, and now we are $4 Trillion more in debt. The thing is, the Fed isn't looking to collect that $4 Trillion. It's a fake debt, not real. The only part of the National Debt we need to care about is the foreign debt.

-

05-25-2025, 03:00 PM #418

Re: Stock Market is f*cked

Re: Stock Market is f*cked

The US is in financial trouble. It is not only the $36-37 trillion but the trillions in OBLIGATIONS (Social Security, Medicare, Federal pensions, etc.) that is owed. Part of that $36-37 trillion is due (short-term) and has to be re-financed. When the US is downgraded (I believe this is the 3rd major indicator that has been downgraded), it signals that investors are not as confident that the US government can pony up and so require a HIGHER rate to buy/re-finance bonds. The more debt, the higher rate is needed and it becomes a spiral.

I believe the government will NOMINALLY "meet" it's obligations - but what those (inflated) dollars will be WORTH - lol - that's something else. Politicians (whether repubs or dems) want to get re-elected - which means no cutting back/austerity (which is what is NEEDED). They all are after the most for their constituents - the debt be damned - with no regard to what the dollar is worth or its status as world's reserve currency.

They need to go to zero-based budgeting - EVERY YEAR, start at ZERO and JUSTIFY spending - not using PREVIOUS budgets (inflated because of COVID spending eg. Medicaid) as starting point.

-

06-26-2025, 03:15 PM #419

-

06-28-2025, 06:30 PM #420

Reply With Quote

Reply With Quote